Come risparmiare?

Incentivi e bonus

In Italy, the installation of high-power heat pumps is incentivized through three types of tax incentives:

Incentivi 2026

CONTO TERMICO

The Conto Termico 3.0 (Ministerial Decree 07/08/2025) is a government incentive administered by the GSE designed to improve the energy efficiency of buildings through upgrades and installation of innovative, high-efficiency systems.

Who is eligible for the Thermal Account?

Eligible for incentives:

- Privati: proprietari di abitazioni, condomìni o gestori di immobili sportivi

- Imprese: aziende di tutte le dimensioni e settori, con aliquote differenziate

- Pubbliche Amministrazioni: amministrazioni locali e centrali, scuole, ospedali, università e laboratori scientifici

- Enti del Terzo Settore (ETS): organizzazioni senza scopo di lucro, sia economiche sia non economiche

- Comunità Energetiche Rinnovabili: sia in forma individuale che collettiva

L’importo massimo incentivabile: fino al 65% per la maggior parte delle categorie, con copertura totale per alcuni soggetti pubblici (scuole, ospedali, edifici comunali piccoli). Fino al 65% per l’installazione di impianti solari termici o sostituzione di generatori con pompe di calore, sistemi ibridi o generatori a biomassa.

La procedura di richiesta dell’incentivo prevede la presentazione telematica tramite il portale GSE entro 90 giorni dalla fine lavori.

Per importi fino a 15.000 euro il rimborso è in unica soluzione.

Oltre i 15.000 euro, l’importo è suddiviso in rate annuali (da 2 a 5).

Come viene erogato l’incentivo?

È cumulabile con altri incentivi di natura non statale e nell’ambito degli interventi in esso specificati, come i contributi in conto capitale, i fondi di garanzia e i fondi di rotazione. NON è cumulabile con la Detrazione Fiscale fino al 50% e nemmeno con i Certificati Bianchi.

Il Conto Termico è cumulabile con altri incentivi?

E2Tech

Valori incentivi

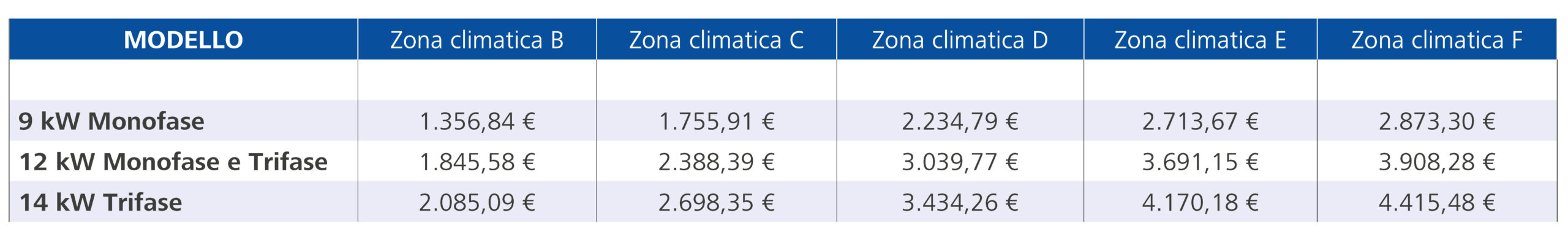

The following table summarizes the economic values recognized by the Conto Termico, differentiated by the relevant climate zone and power of the installed machine.

Incentivi 2026

ECOBONUS 2026

The Ecobonus tax break consists of deductions from Irpef (personal income tax) and Ires (corporate income tax) and is granted when work is carried out that increases the energy efficiency level of existing buildings.

Who is eligible for the Tax Deduction?

Eligible for the deduction are all resident and nonresident taxpayers, including those with business income, who own, in any capacity, the property being worked on:

- Le persone fisiche (inclusi gli esercenti arti e professioni)

- Chi consegue reddito d’impresa (persone fisiche, società di persone, società di capitali)

The prerequisite for taking advantage of the deduction is that the work is carried out on existing real estate units and buildings (or parts of buildings), of any cadastral category, even if rural, including instrumental (for business or professional activities) and those belonging to categories A/1 and A/8, and that they are equipped with a heating system.

Per accedere alla Detrazione Fiscale il contribuente deve inoltrare all’ENEA, entro 90 giorni dalla data di fine lavori, i documenti necessari ed effettuare i pagamenti mediante bonifico.

Per la sostituzione dell’impianto di climatizzazione invernale con:

- Pompa di calore ad alta efficienza (aria-acqua, aria-aria) 30.000 €

- Sistema ibrido (caldaia a condensazione + pompa di calore) 30.000 €

Come accedere alla Detrazione Fiscale?

Con l’approvazione della Legge di Bilancio 2026, è stata confermata la Detrazione Fiscale per gli interventi di efficientamento energetico. Le aliquote di detrazione sono state uniformate al 36% per la maggior parte degli interventi, con un’eccezione per le abitazioni principali dove l’aliquota resta al 50%. Per quanto riguarda la tipologia di interventi ammessi, sono stati eliminati tutti gli incentivi a favore della sostituzione di vecchi generatori con l’installazione di caldaie a gas a condensazione. Queste restano incentivabili i solo se all’interno di sistemi ibridi. La quota da detrarre include i costi del materiale, la progettazione, l’installazione e le certificazioni e va ripartita in 10 quote annuali di pari importo.

Quali sono le detrazioni ammesse per il 2026?

Incentivi 2025

BONUS CASA 2025

As an alternative to energy-saving tax breaks, you can opt for the deduction for building renovation work, until 12/31/2025. As was the case with Ecobonus, the rates for the Home Bonus have been differentiated into interventions carried out on main dwellings, for which the 50 percent rate is confirmed, while interventions carried out on non-main dwellings benefit from a rate that drops to 36 percent. This benefit, governed by Article 16-bis of Presidential Decree 917/86, is provided for the same interventions and is applicable when incurring expenses for renovations of real estate carried out on individual residential real estate units of any cadastral category, with a maximum expenditure limit of 96,000 euros.

Who is eligible for the Tax Deduction?

All taxpayers subject to personal income tax (Irpef), whether or not resident in the territory of the state, are eligible for the Tax Deduction on renovation expenses. The relief is available not only to property owners but also to holders of real/personal rights of enjoyment over the property subject to the interventions and who bear the related expenses.

Tra tutti gli interventi per cui è possibile richiedere la Detrazione, ci sono anche quelli effettuati per il conseguimento di risparmi energetici, con particolare riguardo all’installazione di impianti basati sull’impiego di fonti rinnovabili di energia. Sono stati esclusi dalla detrazione gli interventi di sostituzione di vecchi generatori con caldaie a gas a condensazione. Queste restano incentivabili solo se all’interno di sistemi ibridi. È necessario che l’impianto sia installato a servizio dell’abitazione, anche in assenza di opere edilizie propriamente dette, purché venga prodotta la documentazione attestante il risparmio energetico.

Quali interventi rientrano nella Detrazione?

In fase di avviamento lavori, nei casi in cui è richiesta, va inviata all’azienda sanitaria locale competente (ASL) apposita comunicazione. Entro 90 giorni dalla data di fine lavori è necessario inoltrare all’ENEA scheda informativa relativa agli interventi realizzati, ed è inoltre necessario che i pagamenti siano effettuati con bonifico.